Superannuation does not automatically form part of the estate, it could be subject to taxation

Feature article by Darren Newton – Wealth Management West

To the family, the adopted child is not adopted. They are simply a son, a daughter, a sibling, ……a loved one.

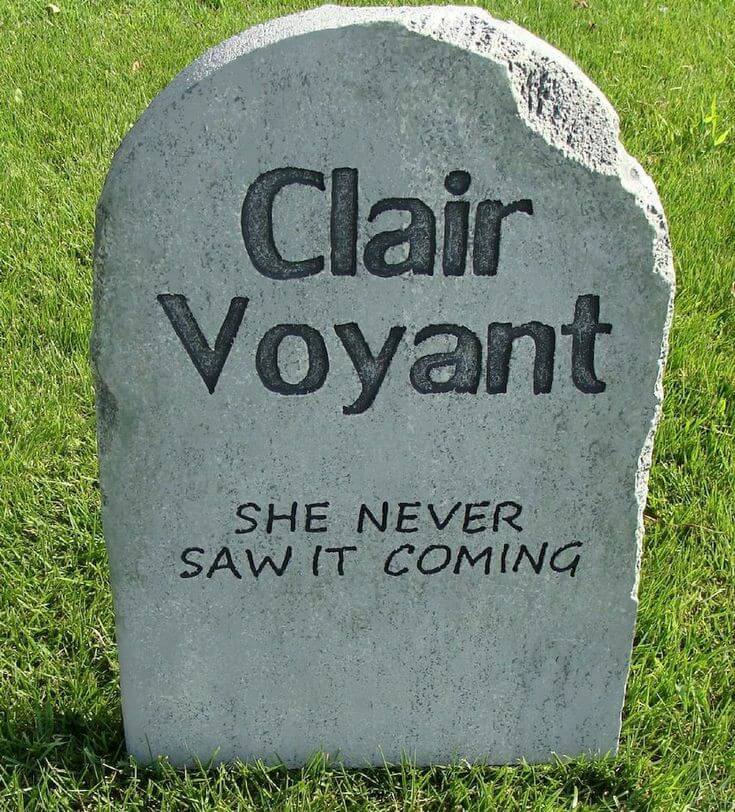

Superannuation is the adopted child of a deceased estate. It is a wanted, loved and an integral part of the family.

But it has a different genes. It does not automatically form part of the estate. It could be subject to taxation.

It should be considered carefully long before its parent passes away.

Many of us do not understand or pay insufficient attention to our superannuation. Superannuation benefits have two components called “Taxable” and “Tax free”. When the “Tax Free” component is paid out to a beneficiary either directly or via the estate, it is not taxable. When the “Taxable” component is paid out, it may be taxed in the hands of the recipient, depending on their relationship to the deceased.

There is no “one size fits all” approach. The approach will depend of the dollars involved, the persons wishes and needs for their family and beneficiaries.

Your grown children, who are not financially dependent on you, may pay tax on their share of the “Taxable” component of your superannuation benefit. If paid direct by the superannuation provider, it will also be subject to the medicare levy. If paid via the estate, the medicare levy can be avoided.

By utilising one or a combination of the below the following, you can manage the taxable impact of the superannuation death benefit payout:

- Use a Binding Death Nomination to direct the superannuation benefit to a tax dependant.

- Building up your tax free component through the use of non concessional contributions, downsizer contributions, and so on.

- Use a re-contribution strategy by drawing down your superannuation and then contributing it back in as a non concessional contribution to build up your “tax free” component.

- If your superannuation benefit is already providing an income stream, ensure that income stream has a reversionary beneficiary who is a tax dependent, ensuring that the benefit remains in the superannuation system rather than being paid out.

- Utilising a “Superannuation Proceeds Trust” activated by your Will so that he superannuation proceeds are quarantined within the estate and directed to people in a tax effective manner.

Allow your adoptive superannuation child to grow up big and confident. Safe in the knowledge that when time comes, they will not be a tax burden on your friends and family.

This is simplistic view of the situation and subject to current legislation. You should consult with your lawyer, adviser, superannuation provider and/or accountant concerning your estate planning requirements.